Safeguarding Your Future: Checking Out the Benefits of Hard Cash Loans

In an ever-changing and unforeseeable monetary landscape, securing your future can feel like a difficult job. Nevertheless, discovering the benefits of tough money finances may simply be the service you have actually been searching for. With a simple and rapid approval process, adaptable terms, and customizable repayment strategies, tough money car loans use a degree of comfort and versatility that conventional lending institutions typically can not match. However that's not all. These fundings also position less dependence on credit scores score and monetary background, opening up chances for people that might have been neglected by various other loan provider. And if time is of the significance, difficult cash car loans give accessibility to fast financing, guaranteeing you do not lose out on time-sensitive opportunities - hard money loans in ga. However wait, there's even more. Hard cash finances usually provide higher loan amounts than their traditional counterparts, giving you the financial leverage required to seek your desires. So, if you're looking for a safe and secure future, discovering the advantages of difficult money fundings is a path worth thinking about.

Fast and Easy Approval Refine

Acquiring a hard cash finance includes the advantage of a very easy and rapid authorization process, making it an attractive alternative for debtors seeking quick financing. Unlike standard car loans, which can take weeks or even months to obtain authorized, hard cash car loans can often be accepted within an issue of days. This is because difficult cash loan providers focus mostly on the value of the property being made use of as collateral, instead of the customer's credit reliability. As an outcome, the approval process is structured, allowing consumers to access the funds they need in a prompt fashion.

The rapid and very easy authorization procedure of difficult cash finances is specifically valuable for people who are in urgent demand of funds. Whether it's for a time-sensitive financial investment chance or to cover unexpected expenditures, tough money car loans provide borrowers with the capacity to protect financing promptly.

Moreover, the very easy approval procedure also benefits borrowers with less-than-perfect credit report. Unlike conventional lending institutions that greatly count on credit rating and income confirmation, hard cash loan providers prioritize the security being utilized to secure the loan. Because of this, customers with a reduced credit report rating or uneven income can still be qualified for a hard cash lending, as long as the worth of the collateral fulfills the loan provider's needs.

Flexible Terms and Adjustable Settlement Plans

Adaptable terms and personalized settlement plans are vital advantages of difficult money finances. Unlike conventional financial institution lendings, which usually have stiff terms and settlement schedules, tough money loan providers offer customers the capacity to tailor their funding terms to their specific demands and financial circumstance. This adaptability allows customers to structure their financings in a manner that works ideal for them, whether it's a temporary lending with greater monthly settlements or a longer-term lending with lower regular monthly settlements.

Among the main benefits of flexible terms is that customers can bargain the length of the lending to fit their private scenarios. If a borrower is in a temporary financial bind and needs fast accessibility to funds, they can decide for a shorter-term financing that can be repaid in a matter of months. On the other hand, if a borrower is looking to fund a lasting financial investment task, they can prepare for a longer-term financing that gives them with even more time to pay off the obtained amount.

Additionally, tough cash loan providers use adjustable repayment strategies, permitting borrowers to choose a payment schedule that lines up with their money flow and revenue. This can be specifically helpful for genuine estate capitalists who depend on rental earnings or building sales to produce money circulation. By personalizing their repayment strategy, debtors can make certain that their financing repayments are manageable and do not place unnecessary pressure on their financial resources.

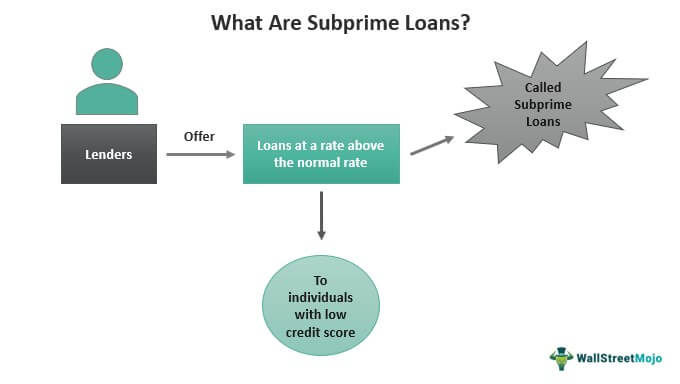

Less Dependence on Credit History and Economic History

Among the noteworthy advantages of difficult money finances is their lowered focus on a borrower's credit rating rating and financial background. Unlike traditional finances that heavily depend on creditworthiness, difficult money lenders mainly concentrate on the collateral supplied by the borrower. This collateral, usually in the form of realty, works as safety and security for the lending and alleviates the threat for the lender. Because of this, individuals with bad credit history or a less than best economic background might still be eligible for a difficult cash financing.

This lowered dependence on credit history and financial history is particularly advantageous for debtors who may have encountered monetary difficulties in the past or have actually been rejected car loans due to their credit report. hard money loans in ga. Tough money lenders are extra thinking about the value and bankability of the collateral, as opposed to the debtor's creditworthiness. This opens up possibilities for individuals that may not receive standard car loans, permitting them to protect the financing they need for various functions, such as realty financial investments or business endeavors

Additionally, tough money financings can offer a quicker and extra structured application and authorization procedure compared to typical car loans. Given that the focus is largely on the collateral, loan providers can make decisions much more efficiently, enabling consumers to gain access to funds in an extra timely way. This can be specifically beneficial in circumstances where time is of the significance, such as when purchasing a home at public auction Web Site or finishing a time-sensitive investment chance.

Access to Quick Financing for Time-Sensitive Opportunities

When it concerns safeguarding funding for time-sensitive chances, difficult money finances offer debtors a quick and effective service, bypassing the typical hurdles of credit report and economic background. Unlike typical loans that need substantial documentation and taxing approval processes, difficult cash financings are made to provide consumers with the funds they need in a timely fashion.

One of the essential advantages of difficult cash finances is the speed at which they can be obtained. In comparison, difficult cash lending institutions concentrate largely on the worth of the collateral being utilized to secure the funding, such as genuine estate.

This quick accessibility to funding is particularly useful for customers that locate themselves in time-sensitive scenarios. Actual estate financiers might come throughout an attractive building that needs prompt financial investment. By securing a tough cash lending, they can act rapidly to take the chance without fretting about lengthy approval procedures.

Moreover, difficult cash fundings can be made use of for a range of time-sensitive chances, such as remodeling a residential property up for sale, buying stock for a limited-time offer, or funding a company expansion. The versatility of tough money fundings enables customers to make the most of special info time-sensitive opportunities in different industries and sectors.

Possible for Higher Car Loan Amounts Than Traditional Lenders

Tough money loans have the potential to supply debtors greater finance quantities compared to those supplied by traditional lending institutions. This is because of the reality that tough cash lending institutions mostly concentrate on the value of the security as opposed to the customer's creditworthiness. Traditional lenders, such as banks and cooperative credit union, usually have stringent borrowing criteria that greatly count on factors like credit history score, debt-to-income, and revenue ratio. Therefore, they might offer reduced financing amounts or even refute the finance application entirely if the debtor doesn't satisfy their requirements.

On the other hand, tough money loan providers are much more worried with the worth of the residential property being made use of as security. They assess the property's market price, place, problem, and possibility for appreciation to figure out the financing amount they agree to provide. This technique allows consumers to access a greater lending quantity based on the residential or commercial property's worth, also if they have a less-than-perfect credit background or other economic difficulties.

The potential for higher finance quantities provided by hard cash loan providers can be specifically valuable genuine estate investors or people seeking to finance residential or commercial property improvements or acquisitions. By having accessibility to a larger financing amount, customers can confiscate successful financial investment chances or implement their real estate tasks more successfully.

Verdict

To conclude, tough money car loans use a easy and fast approval procedure, adaptable terms, and customizable payment strategies. They offer an alternative for people with minimal credit rating history or low credit history to secure funding for time-sensitive chances. Additionally, difficult money finances have the prospective to provide higher car loan amounts compared to traditional loan providers. By taking into consideration these advantages, individuals can explore the benefits of tough money lendings for securing their economic future.

Hard money loans usually use higher loan quantities than their standard equivalents, providing you the economic take advantage of needed to pursue your dreams. Unlike standard click here now bank fundings, which frequently have inflexible terms and repayment schedules, difficult money lenders use debtors the capacity to tailor their financing terms to their specific needs and economic scenario.Moreover, tough cash lendings can provide a quicker and much more structured application and approval process contrasted to standard fundings.Hard money fundings have the prospective to supply borrowers greater car loan quantities compared to those provided by standard loan providers. Furthermore, difficult money loans have the possible to offer higher car loan amounts contrasted to typical loan providers.

:max_bytes(150000):strip_icc()/financing-options.asp_final-dd2cfe64477f48ad8e16969fd6697983.png)